CH. 3 Corporate Governance

43

Risk management

3.3

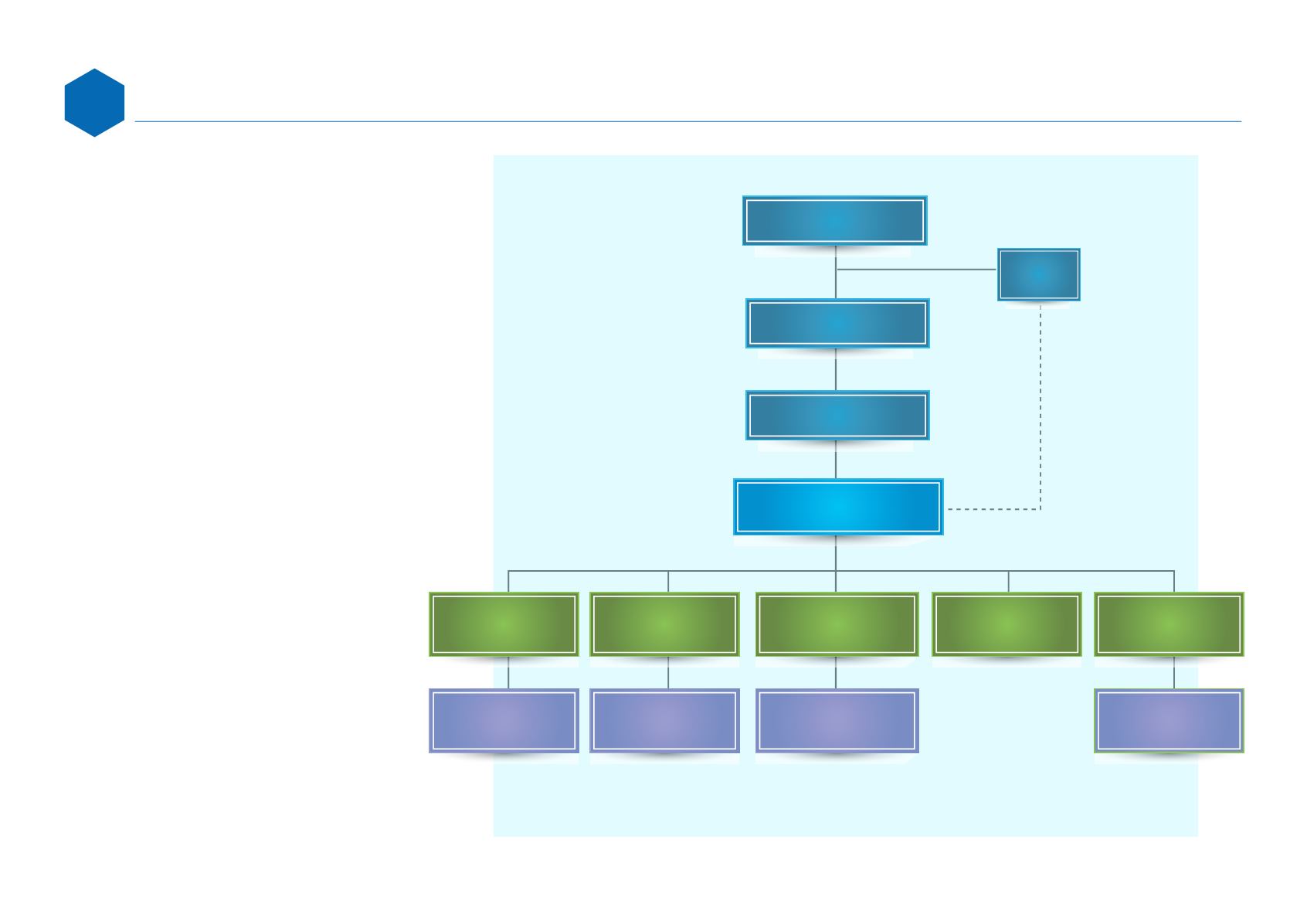

CTCI Corporation is very focused on risk

management, and has introduced a risk

management mechanism in 2006 as well

as formulated "Risk Management Executive

Committee" and established 'Risk Management

Regulation' to actually regulate the risk

management procedures in each department and

each project.

CTCI's primary businesses come from design,

procurement, construction, and Commissioning

Projects. The Company conducts these operations

in matrix organization, and the departments would

be in charge of manpower scheduling, training, and

supporting functions while the project teams would

execute each project. Hence, risk management is

also separated into 2 main scopes: departmental

risks and project risks.

In terms of project risks, based on the

importance of the project, we would hold project

review meetings either weekly, monthly, or

quarterly, and report the implementation status to

departments and the top management, understand

where the risks lie in a project, and seek for

support from departments or from the Company.

The Executive Management Office also routinely

collects information pertaining to the project risks,

and quantifies risks in terms of dollar amount to

control and to continue to track for improvements in

order to lower these risks.

Departmental risks are handled according to the

Risk Management regulation - risks are collected

through risks identification, and evaluation of

severity and probability to get the risk rating, and

the risks will be monitored for improvement for

better control.

Board Meeting

Chairman

President

Auditing

Dept.

HSE Management

Review Meeting

Information Security

Promotion Committee

Quality Management

Review Meeting

Risk of Division/

Department

Proposal Meeting /

Project Review Meeting

Risk of HSE

Risk of

Information Security

Risk of Quality

Management

Risk of Project

Risk Management

Executive Committee